Introduction

Like Jonathan Zasloff, I support states’ efforts to use common law tort actions to address the effect that U.S. sources of greenhouse gases have on global climate change.[1] Also like Zasloff, I believe such litigation constitutes a reasonable alternative to Congress’s failure to address this problem. Tort law provides the concepts necessary[2] to address the liability of greenhouse gas contributors. In addition, litigation may trigger a political response[3] to the climate crisis. To paraphrase Zasloff, litigation is no more imperfect than the other proposed imperfect alternatives.[4] But while we both belong to a minority of legal commentators who support common law climate litigation, Zasloff and I part company on a critical aspect of the litigation: the requested relief.

Zasloff argues that U.S. plaintiffs in climate tort cases should request damages rather than the abatement of the defendant’s greenhouse gas emissions.[5] He has criticized my suggestion that courts allow defendants to comply with such abatement orders through the use of emissions offsets procured from third parties.[6] Zasloff further argues that the proper measure of the climate plaintiff’s damages from a given defendant is the carbon tax associated with the defendant’s total emissions. For example, Zasloff argues that the proper measure of California’s damages from a given coal-fired power plant’s history of greenhouse gas emissions is the portion of the plant’s total carbon tax represented by California’s portion of the total U.S. population.[7]

The basic problem with Zasloff’s suggestion is that a carbon tax is a measure of global damages from the emission of a ton of carbon dioxide and not a measure of a given plaintiff’s climate change–related losses. An optimal carbon tax reflects, on an average per ton basis, the price upon carbon emissions which ensures that the global damages resulting from such emissions do not exceed the economic benefits resulting from the same emissions.[8] Applied to a given climate defendant, a carbon tax indicates the average global damages attributable to each ton of the defendant’s emissions. Thus, a carbon tax fails to satisfy the threshold criteria for tort damages—compensating the plaintiff for its losses—and, more importantly, any tax collected by a U.S. climate plaintiff should be shared with all persons in the world.

Even if reduced to reflect the plaintiff’s fraction of the U.S. population when the plaintiff is a state, U.S. climate plaintiffs’ recovery of the total carbon tax associated with every ton of a defendant’s historic carbon emissions would vastly overcompensate U.S. plaintiffs. Considering that a defendant’s emissions contribute to the global buildup of greenhouse gas concentrations that causes anthropogenic climate change, persons residing in other parts of the world are just as entitled as U.S. plaintiffs to any carbon tax collected. To award the entire tax to a U.S. plaintiff threatens to “cash out” these other persons’ claim to compensation for the harm that they will continue to sustain from the historic emissions of greenhouse gases from U.S. sources.[9]

The international justice implications of using a global carbon tax as a measure of damages are an important reason for U.S. courts to limit themselves to awarding abatement relief in climate nuisance cases. While precedent would allow a court to require the total abatement of the defendant’s emissions,[10] Zasloff’s idea of a carbon tax is an excellent metric for determining the defendant’s globally fair abatement level. The level of abatement corresponding to the level at which the defendant’s marginal abatement cost equals the optimal global carbon tax constitutes a reasonable approximation of the defendant’s fair share of the carbon reductions that will be required to avoid global climate change damages. Thus, imposing abatement at the level of a carbon tax harmonizes the remedy in national climate change litigation with the global abatement that is needed without unfairly allocating the tax solely to U.S. plaintiffs. This remedy could be flexible so that a given defendant need not comply by actually abating its emissions but could instead satisfy the judgment by proffering third-party emissions-offset credits.

The debate over damages versus abatement relief has important ramifications for the future viability of climate tort litigation. At the heart of the debate is the concern about what subglobal adjudication can realistically and fairly accomplish with respect to climate change. In our zeal to use the power of the courts and the common law to address climate change, especially in the wake of Congress’s inaction,[11] it is important that we not lose sight of the global aspects of the climate change problem, especially when these global aspects have international justice implications.

As a final introductory note, climate litigation is likely to continue in the United States, at least so long as Congress fails to enact comprehensive climate legislation. This is true despite the legal uncertainty that has resulted from the U.S. Supreme Court’s decision to hear the industry’s appeal of the Second Circuit’s ruling in the flagship climate nuisance case Connecticut v. American Electric Power.[12] Even the success of the industry respondents’ effort to dismiss the plaintiffs’ federal common law nuisance claim may only shift the litigation to state nuisance claims.[13]

I. The Scope of Our Knowledge of the Climate Change Damages Attributable to a Given Defendant

Anthropogenic climate change is the alteration of the global climate system beyond natural variability, which scientists attribute to the unprecedented buildup in global greenhouse gas emissions over the past century.[14] The effects of climate change that damage human societies, such as rising sea levels and higher average surface land temperatures, flow from this global buildup.[15] Greenhouse gas emissions from a given source—a coal-fired utility plant or an automobile—contribute to these aggregate global levels. Emissions of greenhouse gases mix well in the atmosphere.[16] An array of models that integrate climate with economic systems can now project total global damages attributable to various levels of world greenhouse gas emissions and their corresponding temperature increases. Although uncertain in many respects, such models can roughly correlate the amount of global damages resulting from temperature increases, plotting the approximate slope of the upward-trending global temperature–damages curve.[17]

But while economists can estimate the global damages that result from aggregate world emissions of greenhouse gases, they have much trouble doing so for the damages sustained by a single plaintiff at the hands of one or even many individual sources of greenhouse gas emissions. This is not because the greenhouse gas emissions from an individual source cause no damage. This is true, but the connotation—that the proportionately small amount of greenhouse gases emitted by a single source causes no damages—is incorrect. Because the marginal damage curve slopes upward from zero damages, each ton of greenhouse gas emitted imposes some measure of damages. Indeed, we know that the world aggregate greenhouse gas emissions impose considerable damages and that each ton emitted contributes to this global total. More accurately, then, the difficulty in estimating the amount of a given plaintiff’s climate damages that are attributable to a given defendant’s greenhouse gas emissions is two-fold: (1) the indeterminacy of the marginal global damage attributable to the defendant’s emissions, and (2) the further difficulty of determining the plaintiff’s proper allocation of global damages.

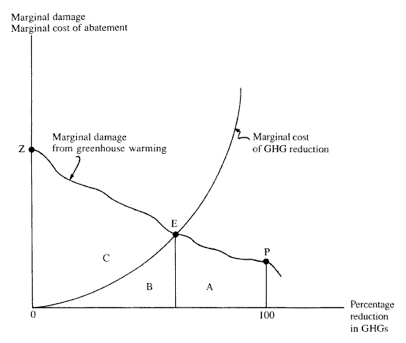

First, the upward slope of the marginal damage curve means that the damages associated with the emission of any given ton of greenhouse gas will differ depending upon the concentration of greenhouse gases already in the atmosphere. As shown in Figure 1, at a given point in time, the first ton of a greenhouse gas from anthropogenic sources added to natural background concentrations of greenhouse gases, imposing the smallest amount of marginal damages, while the last such ton added imposed the greatest measure of marginal damages.[18] We have no way of knowing, however, when the given emissions source emitted the greenhouse gases, and hence we cannot know whether the marginal damages attributable to a given defendant’s emissions are relatively small or large.

Figure 1. Marginal Costs of GHG Reductions and Marginal Damage From GHG Emissions[19]

Thus, the more accurate characterization of the damages attributable to a single source of greenhouse gas emissions is not that the damages are zero but that their size is indeterminate.

Second, the climate damages attributable to any given source of greenhouse gas emissions are global in nature. These emissions contribute to a global buildup of greenhouse gas concentrations that is responsible for changes in weather patterns and climatic events, which in turn impose damages on persons and localities throughout the world. For example, greenhouse gas emissions from a West Virginia coal-fired utility plant owned by a defendant corporation in a U.S. climate nuisance lawsuit contribute to global concentrations of greenhouse gases that increase mean surface temperatures; this increase causes the thermal expansion of the world’s oceans. This thermal expansion leads not only to the rise of the Atlantic Ocean, which damages the coast of Connecticut, the lead plaintiff in American Electric Power, but also to the rise of the Pacific Ocean, which threatens to submerge the small island nation of Tuvalu. The second problem inherent in a climate nuisance damages remedy, then, lies in properly determining what proportion of the global damages attributable to a given source’s greenhouse gas emissions to allocate to a single plaintiff, even one the size of a U.S. state that represents millions of persons.

A. Legal and Methodological Hurdles to a Damages Remedy in Climate Nuisance Lawsuits

As Zasloff recognizes, a plaintiff seeking damages in a common law climate lawsuit confronts an array of hurdles, both legal and methodological.[20] Unfortunately, a carbon tax affords little help in overcoming these hurdles.

Assuming that the plaintiff can sue for damages and is not limited to a suit for abatement,[21] the first hurdle is that courts usually calculate damages by reference to the plaintiff’s loss or harm, as opposed to the defendant’s conduct.[22] Accordingly, the plaintiffs that are seeking or have sought damages attributable to climate change can claim compensation for personal injuries or property losses attributable to weather or climatic events that they claim are caused by climate change. Hence, in Comer v. Murphy Oil USA,[23] Mississippi Gulf Coast property owners claimed personal and property damages from Hurricane Katrina, which they allege was made more ferocious by the defendants’ emission of greenhouse gases.[24] Similarly, the plaintiffs in Native Village of Kivalina v. Exxon Mobil Corp.[25] are seeking to recoup the costs of relocating their village to higher land, a cost they claim they will have to incur in the future as a result of the defendants’ contributions to global warming, which is causing sea level rise.[26] In seeking damages, these plaintiffs confront the problem that scientists cannot say with any degree of certainty that a particular weather or climatic event was caused by the buildup of greenhouse gases resulting from anthropogenic emissions, as opposed to natural variability.[27] The most that scientists can tell us is the likelihood that a given climatic trend, such as an increase in global average temperature or a given amount of sea level rise, is caused by human-generated emissions.[28]

Unfortunately, as a measure of the harm imposed by the defendant, as opposed to the injury experienced by the plaintiff, a carbon tax does not fit the mold of a compensatory damage measure and hence does little to help the plaintiff establish a claim to damages. Zasloff nevertheless insists that a carbon tax can be used as a measure of the plaintiff’s losses if it is properly reduced.[29] Zasloff suggests that a carbon tax be discounted twice, once to reflect the fact that the defendant’s greenhouse gas emissions represent a small proportion of the world’s total greenhouse gas emissions and a second time to reflect the possibility that the plaintiff’s loss was caused by weather or climatic events driven by natural variability rather than anthropogenic climate change.[30]

However reduced, a carbon tax is still a measure of the harm imposed by the defendant, as opposed to the loss sustained by the plaintiff. Additionally, this proposal suffers from the very defect Zasloff (rightfully) identified in an abatement remedy: the lack of a substantive metric by which to determine the ultimate level of such a tax. By how much should the carbon tax be discounted? How big is the risk that a particular hurricane, for example, increased in strength or that a particular wildfire began as a result of warmer temperatures attributable to a buildup of greenhouse gases? Scientists are beginning to estimate the amount of risk attributable to the sum total of human-caused greenhouse gas emissions within a given climatic event. However, this development is very new, and scientists are still far from being able to estimate the increased risk attributable to a single emissions source.[31]

Finally, used as a measure of past damages, a carbon tax raises tricky methodological issues related to the correlation between rising marginal damages and rising greenhouse gas concentrations. A plaintiff’s total damages award will clearly increase as it goes further back in time in requesting damages for the defendant’s historic emissions.[32] Yet the earlier the year for which damages are sought, the smaller the size of the per-ton carbon tax since the marginal cost of climate change damages is increasing over time because of increasing greenhouse gas concentrations.[33] Thus, according to the very logic of a carbon tax, the size of a plaintiff’s past damages award based on such a tax will be a function not only of the size of the defendant’s emissions and the length of time for which the defendant can be held liable for its emissions, but also of the steepness of the slope of the global damages curve—a matter that is hotly debated.[34]

Granted, damages awarded in common law cases do not always reflect the actual amount of harm sustained by the plaintiff. In many cases, the damages award simply reflects a legal convention.[35] One could argue that, in a similar fashion, a court could develop a convention that uses the defendant’s historic emissions to measure a climate plaintiff’s damages. Based on its implications for climate justice, however, I argue against such an approach in the next Subpart.

B. Who Should Receive the Carbon Tax? Considerations

of International Justice and Selfishness

Even if a court accepted a carbon tax applied to a defendant’s historic carbon emissions as an appropriate measure of a U.S. plaintiff’s losses attributable to global climate change, the plaintiff may not be entitled to the whole tax. This is because a carbon tax reflects the sum total of the damages sustained from a ton of carbon by the world as a whole, not just the damages sustained solely by the plaintiff, even a plaintiff the size of a U.S. state. Assuming a carbon tax of thirty dollars per ton, for example, California is arguably not entitled to the full amount since it sustains only a fraction of the worldwide damages attributable to the ton of carbon that is reflected in this thirty-dollar figure. As a result, Zasloff cannot be correct when he states:

The initial damages/tax calculation would be the prorated per capita population share by state. If we say that the U.S. carbon tax should be $25 a ton, then we would take a source’s emissions, multiply them by the population percentage of a state, and arrive at the damages product. California’s population of a little more than thirty-nine million is about 12.2 percent of the total U.S. count.[36]

For California’s share to equal 12.2 percent of the total tax collected, the defendant’s emissions must have only harmed the United States, which is of course not correct. The emissions from the defendants’ coal-fired electric plants in Connecticut v. American Electric Power,[37] for example, contribute to global concentrations of greenhouse gases that are changing the earth’s climate, which in turn increases the likelihood of droughts in Africa, flooding in Asia, and rising sea levels on the California coast.[38] To claim the whole tax for the United States (or for California to claim a proportion equivalent to its portion of the U.S. population) clearly overstates the United States’ (or California’s) true share of the damages. The damages endured by California from a ton of carbon dioxide emitted by a West Virginia power plant, for example, must be shared not just with the population residing in the other forty-nine states, but with the remaining 6.836 billion persons in the world.[39]

One might argue that allowing the United States to collect the whole tax (and hence a proportional fraction of the total for a U.S. state) is fair in the sense that the United States has sustained damages from sources of greenhouse gas emissions in other countries for which it has not received compensation. For example, coal-fired power plants in China contribute just as much to climate change as similar U.S. plants, and yet Americans are not collecting a carbon tax from these Chinese counterparts. Hence, one could argue that in lieu of each jurisdiction collecting the fraction of its damages attributable to all sources of carbon emissions worldwide, allowing each country to collect the full measure of the damages imposed by the emissions sources within its borders is a satisfactory solution. If all countries had equal per capita emissions, then a country’s collection of a pro rata share of damages from every source in the world and the collection of the whole of the damages imposed by one’s domestic emissions sources would be the same. Under this scenario, there would be nothing wrong with the United States collecting all of the damages attributable to its own carbon emission sources. However, countries have vastly different per capita emissions.[40] Because the United States has one of the largest per capita emissions,[41] a country-by-country approach works to the advantage of U.S. plaintiffs and to the detriment of residents of most other nations, especially developing countries.

The potential for such lopsided climate damages recovery should be of concern to the United States for two reasons. First, the United States should be concerned about the fundamental unfairness of allowing U.S. plaintiffs to recover the whole of the damages shared by the world that are attributable to U.S. sources’ past emissions. This is especially the case when the benefits of these emissions flowed most directly to U.S. residents—in the form of economic prosperity—and only indirectly to the residents of developing countries.[42] While residents of developing countries may not have a realistic basis for recovering payments for their share of the damages in a court of law, their damages claim has viability in the form of adaptation funding from developed countries within the context of international climate negotiations. Indeed, the damages claim for the historic emissions from developed countries is a primary basis for lesser developed countries’ claim for adaptation funding from developed nations.[43] For some commentators, this equitable claim is the basis for transferring money from developed to developing countries under several international legal instruments, among them the Least Developed Countries Fund, the Special Climate Change Fund, and the Adaptation Fund under the Kyoto Protocol.[44] To allow U.S. plaintiffs to recover all of these historic damages by collecting 100 percent of the carbon tax associated with past emissions threatens to cash out developing countries’ claims.[45]

Second, the United States should also be concerned about the country-by-country approach for purely self-interested reasons as well. The United States is responsible for a large fraction of the damages attributable to current emissions of greenhouse gases as a result of the disproportionate size of its emissions vis-à-vis other countries.[46] But this is changing as the relative size of the United States’ share of global greenhouse gas emissions dwindles.[47] In the future, the United States will have the greater claim to damages from climate change because its emissions will constitute only a small fraction of total global emissions given the growth of rapidly industrializing countries such as China and India.[48] Hence, today’s precedent under the country-by-country approach, which allows U.S. plaintiffs to recover more than their fair share of past climate damages by permitting them to reap 100 percent of the global damages attributable to U.S. emissions sources, will only work against U.S. plaintiffs in the future when the total climate damages sustained by U.S. plaintiffs will exceed what they can collect in lawsuits filed solely against U.S. emitters.

II. A Better Idea: Use a Carbon Tax to Determine the Level of Abatement Required

One might assume that injunctive relief faces the same legal and justice barriers as a damages remedy: the inability to link the particular harms sustained by a climate plaintiff to a particular defendant’s greenhouse gas emissions. In this Part, I argue that such is not the case. Under a capacious understanding of their equitable powers, courts have imposed injunctions in the analogous situation in which the defendant is clearly contributing to an aggregate harm, but the exact scope of that contribution is unknown. Furthermore, because abatement is prospective, it does not result in overcompensating U.S. climate plaintiffs to the potential detriment of foreign climate plaintiffs. In this context, Zasloff’s reference to a carbon tax is extremely helpful as it supplies a reasonable metric for determining the level of abatement that a court might require.

In terms of doctrine, U.S. courts have applied the English common law’s combined effects rule to order abatement of conduct contributing to a nuisance despite the unavailability of damages.[49] The combined effects rule holds that each individual is liable for the combined effect of all when the combined effect of many persons’ actions constitutes a nuisance but the effect of any individual’s actions would not constitute a nuisance.[50] Thus, in the Maryland case of Woodyear v. Schaeffer,[51] the plaintiff-owner of a large flour mill sued a slaughterhouse in nuisance, seeking relief for the defendant’s contribution of approximately fifteen buckets of blood per week discharged to the stream above the plaintiff’s mill.[52] Given the large number of other establishments, including other slaughterhouses, that used the same waterway to dispose of their sewerage, the court found that, although collectively the pollution sources imposed substantial harm, each contributor “standing alone, might amount to little or nothing.”[53] As a result, “it would be difficult to apportion the damage, or say how far any one may have contributed to the result, and so damages would likely be but nominal.”[54] Nevertheless, the court imposed a total injunction on the defendant, holding that equity should prevent a nuisance when damages are inadequate compensation.[55]

As Woodyear and other cases demonstrate,[56] precedent exists for a court to order the total abatement of the defendant’s contribution to a public nuisance. In these cases, the court enjoined the defendant from contributing even a proportionately miniscule fraction of a much larger harm resulting from the combination of many persons’ actions.

If an order for the total abatement of a small contribution to a much larger public nuisance can be justified, something less than total abatement can be justified as well. In the context of climate change, it is reasonable that the “something less” be the abatement level corresponding to the defendant’s payment of an optimal international carbon tax. Although Zasloff’s carbon tax suggestion is problematic when used as the basis for U.S. plaintiffs’ recovery of climate damages, it offers a reasonable level for the defendant’s prospective abatement obligation. The point at which a defendant’s marginal costs equal the optimal carbon tax represents a fair per source allocation of the global burden to reduce greenhouse gas emissions. Zasloff criticizes my earlier support for an abatement remedy based in part on my failure to suggest a substantive metric that a court might use to determine the level of reductions necessary for a given source.[57] Interestingly enough, Zasloff’s idea of a carbon tax is an excellent candidate for this metric.

The implementation of the carbon-tax-as-abatement level could also afford the defendant-emitter maximum flexibility for compliance. Zasloff contends that injunctive relief represents specific deterrence,[58] which hamstrings the defendant by dictating exactly what it must do to comply with a court order. In contrast, he argues that damages represent general deterrence,[59] which gives the defendant flexibility in complying with the court’s order.[60] For instance, Zasloff mentions that defendants subject to a damages judgment need simply “write a check,” while defendants subject to orders for injunctive relief must perform particular tasks.[61] But this need not be the case. As I have suggested previously, judges could allow defendants to comply with an abatement order through the proffer of third-party offset credits. Such credits, or guarantees of emissions reductions, could substitute for emissions reductions at the defendant’s own facilities.[62] Under this scenario, the defendant might comply with an injunction by simply writing a check.

Used merely as a measure for the level of abatement, a carbon tax would not result in a U.S. court’s overcompensation of a few lucky plaintiffs or the overcompensation of anyone. Instead, an institution that more fairly represents the interest of all persons in the world subject to climate damages could allocate compensation claims. Whether such an institution is the framework for future international climate negotiations or, as others have suggested, an international climate compensation tribunal,[63] it is important that the chosen institution reflect the interests of all damaged parties, both past and future.

Not only is there precedent for using abatement to address the real but unknowable harm imposed by a small contributor to a much larger aggregate harm, but abatement relief avoids the international justice problems caused by using a carbon tax to compute a U.S. plaintiff’s damages from the historic greenhouse gas emissions of U.S. sources. Quite simply, abatement achieves the same reduction in the defendant’s emissions without paying the plaintiff for past emissions that exceed its fair share of the global damages attributable to such emissions. In terms of the actual level of emissions achieved, the rational regulator seeking to achieve efficient emissions levels obtains the same result whether she regulates a firm’s emissions via a Pigouvian tax[64] or by specifying a particular level of abatement. The rational emitter will reduce emissions up to the point that the marginal price of further abatement exceeds the marginal damage cost.[65]

Conclusion

As Zasloff recognizes, one of the benefits of U.S. climate tort litigation is its potential to get the political process to respond to the climate crisis. Damages might be the remedy of choice in such litigation, given the potentially greater deterrence value of damages vis-à-vis injunctive relief. Large greenhouse gas emitters that must pay damages to U.S. plaintiffs for past emissions in the amount of an optimal carbon tax might support comprehensive climate change regulation, perhaps in exchange for congressional preemption of liability for damages. Such deterrence must be weighed against the possibility that the award could unfairly enrich U.S. plaintiffs at the expense of persons living in other parts of the world who also sustained injuries from the defendant’s emissions. To avoid such a result, U.S. courts should limit their relief to prospective injunctive relief. In that regard, the level of abatement that a defendant would adopt if it were compelled to pay an optimal carbon tax constitutes a globally fair measure of the defendant’s abatement obligation. Climate damages are then best left to an international institution that can more fairly adjudicate the competing claims of the world’s population to the damages attributable to a given source’s greenhouse gas emissions.[66]

* Professor of Law, James E. Rogers College of Law, University of Arizona. I wish to thank Dan Dobbs, David Driesen, Carol Rose, and Scott Saleska for their thoughtful comments on an earlier draft and each of the participants in the Works-in-Progress Seminar at the James E. Rogers College of Law, University of Arizona. Last but certainly not least, I wish to thank Krista Germeroth for her excellent research assistance. [1]. Jonathan Zasloff, The Judicial Carbon Tax: Reconstructing Public Nuisance and Climate Change, 55 UCLA L. Rev. 1827 (2008).

[2]. A major impediment to the use of tort law to address conduct contributing to climate change is the difficulty of attributing harm from an activity known to cause climate change, such as the emission of greenhouse gases, to individual sources of greenhouse gas emissions. As discussed infra, see text accomp-anying notes 49–56, courts have handled analogous situations through the imposition of injunctive relief.

[3]. For example, tort actions filed against industrial sources of greenhouse gases could prompt the defendants to support federal legislation incorporating mandatory greenhouse gas emissions cuts thereby rending the passage of such legislation more likely. Although Congress has yet to enact compre-hensive climate legislation, one of the defendants in the Connecticut v. American Electric Power lawsuit announced its support of federal legislation shortly after being named in the suit. See Jeffrey Ball & Antonio Regalado, Cinergy Backs U.S. Emissions Cap, Wall St. J., Dec. 2, 2004, at A6 (“Cinergy Corp., one of the nation’s biggest electric utilities, endorsed the idea of a national cap on global-warming emissions and . . . believes . . . that Congress should [regulate] to ‘take the unnecessary uncertainty out of national environmental policy.’”).

[4]. Zasloff, supra note 1, at 1829.

[5]. Zasloff’s argument in favor of damages is generally targeted at American Electric Power Co. v. Connecticut, in which the plaintiffs, eight states and New York City, requested only abatement of the six defendant electric power companies. Complaint at 49, Connecticut v. Am. Elec. Power Co., 406 F. Supp. 2d 265 (S.D.N.Y. 2005), vacated, 582 F.3d 309 (2d Cir. 2009), cert. granted, 2010 U.S. LEXIS 9461 (Dec. 6, 2010) (No.10-174), available at http://ag.ca.gov/globalwarming/pdf/Connecticut_

%20AEP_Complaint_2004July24.pdf (praying for an order “[p]ermanently enjoining each defendant to abate its contribution to the nuisance by requiring it to cap its carbon dioxide emissions and then reduce them by a specified percentage each year for at least a decade”). Plaintiffs in the other climate-nuisance cases are requesting or have requested damages, though these damages are not based on a carbon tax. See Comer v. Murphy Oil USA, 585 F.3d 855, 859 (5th Cir. 2009), vacated, 607 F.3d 1049 (5th Cir. 2010) (requesting compensatory and punitive damages) (vacated for failure to muster a quorum to rehear the case en banc); Native Vill. of Kivalina v. Exxon Mobil Corp., 663 F. Supp. 2d 863, 869 (N.D. Cal. 2009) (requesting the costs of relocating a native Alaskan village, “estimated to range from $95 to $400 million”); California v. Gen. Motors Corp., No. C06-05755 MJJ, 2007 WL 2726871, at *2, 17 (N.D. Cal. Sept. 17, 2007) (past and future monetary damages) (dismissing the case). American Electric Power has taken on added significance since the U.S. Supreme Court has agreed to hear the case. Am. Elec. Power Co. v. Connecticut, 2010 U.S. LEXIS 9461 (Dec. 6, 2010) (No.10-174).

[6]. Zasloff, supra note 1, at 1839–43 (critiquing the proposal in Kirsten H. Engel, Harmonizing Regulatory and Litigation Approaches to Climate Change Mitigation: Incorporating Tradable Emissions Offsets Into Common Law Remedies, 155 U. Pa. L. Rev. 1563 (2007)).

[7]. Zasloff, supra note 1, at 1865.

[8]. William D. Nordhaus, A Question of Balance 15 (2008).

[9]. Developing countries’ claim to adaptation funding during international climate negotiations is an example of a claim by non-U.S. citizens to compensation from the historic emissions by U.S. sources.

[10]. See infra cases cited in notes 50–56.

[11]. This past July, the Senate Democratic leadership dropped its efforts to pass a bill, drafted by Senators John Kerry and Joseph Lieberman, that would curb greenhouse gas emissions. Perry Bacon Jr., Lack of Votes for Senate Democrats’ Energy Bill May Mean the End, Wash. Post, July 23, 2010, at A2. The Kerry-Lieberman Senate bill was the best hope for passing comprehensive climate change legislation after the House approved the Waxman-Markey bill in June 2009—the first-ever climate bill passed by a house of Congress. Ryan Lizza, As the World Burns: How the Senate and the White House Missed Their Best Chance to Deal With Climate Change, New Yorker, Oct. 11, 2010, at 70.

[12]. See Brief for the Tennessee Valley Authority in Support of Petitioners, Am. Elec. Power Co. v. Connecticut, No. 10-174 (U.S. filed Aug. 24, 2010), 2010 WL 3337661 (arguing that EPA regulation of greenhouse gas emissions from stationary sources displaces plaintiffs’ federal common law nuisance claim and thus requesting that the Second Circuit’s decision, which was favorable to the plaintiffs and limited to their federal common law nuisance claim, be vacated and the case remanded to the district court to possibly consider the plaintiffs’ state nuisance claims).

[13]. The federal courts have crafted a body of federal common law to decide interstate conflicts that would be considered actions for nuisance under state law were they to involve wholly intrastate resources. In Georgia v. Tennessee Copper, 206 U.S. 230 (1907), the federal common law nuisance claim provided the basis for the Court’s injunction of a Tennessee copper smelter whose fumes were destroying Georgia’s forests. Similarly, in the first of two cases to reach the Supreme Court, the Court upheld the application of the federal common law of nuisance to Illinois, which brought suit against Milwaukee for the discharge of untreated sewage into Lake Michigan. Illinois v. Milwaukee (Milwaukee I), 406 U.S. 91 (1972). In the second case, the Court demonstrated the limits of the federal common law of nuisance when it dismissed Illinois’ suit as preempted by Congress’ recent enactment of the Clean Water Act. Milwaukee v. Illinois (Milwaukee II), 451 U.S. 304 (1981). As discussed in note 12, supra, federal preemption is also the basis of the Tennessee Valley Authority’s effort to dismiss the federal common law nuisance claim filed against it and other electric generating companies in Connecticut v. American Electric Power. As demonstrated by subsequent Supreme Court case law, however, a state common law nuisance action may survive the dismissal of federal common law nuisance claims based on federal preemption. In International Paper Co. v. Ouellette, the Court held that, despite the compre-hensive nature of the Act’s permitting scheme, the Clean Water Act’s savings clause preserved claims against out-of-state sources based on the law of the state in which a polluting source is located. 479 U.S. 481, 494 (1987).

[14]. Working Group I, Intergovernmental Panel on Climate Change, IPCC Fourth Assessment Report: Climate Change 2007: The Physical Science Basis, Understanding and Attributing Climate Change (2007), available at http://www.ipcc.ch/publications_and_data/ar4/

wg1/en/spmsspm-understanding-and.html.

[15]. See Intergovernmental Panel on Climate Change, Climate Change 2007: The Physical Science Basis, Synthesis Report 23–24 (Susan Solomon, Dahe Qin & Martin Manning eds., 2007), available at http://www.ipcc.ch/pdf/assessment-report/ar4/wg1/ar4-wg1-ts.pdf.

[16]. European Env’t Agency, Atmospheric Greenhouse Gas Concentrations (CSI 013) Assessment (2010), available at http://www.eea.europa.eu/data-and-maps/indicators/atmospheric-greenhouse-gas-concentrations/atmospheric-greenhouse-gas-concentrations-assessment-3#toc-0 (finding that the global average values of greenhouse gases are justified because of the uniform mixing of greenhouse gases around the globe).

[17]. See, e.g., William D. Nordhaus & Joseph Boyer, Warming the World: Economic Models of Global Warming (2000); Leon Clarke et al., International Climate Policy Architectures: Overview of the EMF 22 International Scenarios, 31 Energy Econ. 564 (2009); Richard S.J. Tol, Estimates of the Damage Costs of Climate Change, Part I: Benchmark Estimates, 21 Envtl. & Resource Econ. 47 (2002); Richard S.J. Tol, Estimates of the Damage Costs of Climate Change, Part II: Dynamic Estimates, 21 Envtl. & Resource Econ. 135 (2002).

[18]. The characterization of the emissions as the “first” and “last” ton emitted is meant to convey the amount of emissions over background levels of greenhouse gases in the atmosphere and not the chrono-logical order of the emissions.

[19]. William D. Nordhaus, To Slow or Not to Slow: The Economics of the Greenhouse Effect, 101 Econ. J. 920, 924 fig. 1 (1991).

[20]. Zasloff, supra note 1, at 1867–68.

[21]. To the extent that the climate plaintiffs are public entities suing under public nuisance, such as the U.S. states in American Electric Power, it is not clear that they have an action for damages, as opposed to an action solely for the abatement of the nuisance. The common law provides private persons with a claim for damages so long as they demonstrate a special injury different in kind from that experienced by the public at large. Restatement (Second) of Torts § 821C(1) (1979). In contrast, the common law provides public officials with an action for abatement. Id. § 821C(2). The legislature can broaden the remedies available to government officials to include damages in situations in which only abatement might be available under the common law. Thus, the Oil Pollution Act of 1990 and the Superfund Law (CERCLA) specifically authorize federal and state officials, acting in their capacity as natural resource trustees, to sue for damages from releases of hazardous substances and oil spills. See 33 U.S.C. § 2706 (2006); 42 U.S.C. § 9607(f)(1) (2006).

[22]. Dan B. Dobbs, Law of Remedies § 3.1, at 208–09 (2d ed. 1993). The exception, of course, is punitive damages.

[23]. 585 F.3d 855 (5th Cir. 2009).

[25]. 663 F. Supp. 2d 863 (N.D. Cal. 2009), appeal docketed, No. 09-17490 (9th Cir. Nov. 6, 2009).

[27]. See Myles R. Allen & Richard Lord, The Blame Game: Who Will Pay for the Damaging Consequences of Climate Change?, 432 Nature 551, 551 (2004).

[28]. See Climate Change 2007: Synthesis Report, Fourth Assessment Report of the Intergovernmental Panel on Climate Change (Rajendra K. Pachauri & Andy Reisinger eds., 2007) [hereinafter Synthesis Report], available at http://www.ipcc.ch/pdf/assessment-report/ar4/syr/

ar4_syr.pdf.

[29]. Zasloff, supra note 1, at 1843, 1864, 1871.

[31]. See Peter A. Stott, D.A. Stone & M.R. Allen, Human Contribution to the European Heatwave of 2003, 432 Nature 610, 612 (2004) (estimating that human influence is to blame for 75 percent of the increased risk that the 2003 European heatwave would occur).

[32]. How far back in time a plaintiff goes will depend on the standard of liability applied and, if negligence applies, on the defendant’s knowledge. If strict liability applies and no statute of limitations stands in the way, a plaintiff should be able to request that a defendant pay for all damages attributable to every ton of greenhouse gas it has emitted from the start of its operations, regardless of when that start date occurred. If negligence applies, however, how far back in time the plaintiff can request damages will turn on whether the defendant should have known that its emissions would cause environmental damage. Certainly such knowledge was available in 1992 when a majority of the world’s nations, including the United States, ratified the United Nations Framework Convention on Climate Change, acknowledging the link between anthropogenic emissions of greenhouse gases and adverse environmental impacts. But the defendant possibly should have known of this link even earlier. See United Nations Framework Convention on Climate Change 1, FCCC/INFORMAL/8 GE.05-62220 (E) 20070, reprinted in 31 Int’l Legal Materials 849 (1992), available at http://unfccc.int/resource/docs/convkp/

conveng.pdf. For instance, the 1972 Stockholm Convention explicitly discussed climate change. Peter Jackson, From Stockholm to Kyoto: A Brief History of Climate Change, U.N. Chron., June 1, at 6, 6–7 (2007). The world’s first climate conference, sponsored by the World Meteorological Association, occurred in 1979. See World Meteorological Org., World Climate Conference: A Conference of Experts on Climate and Mankind (Feb. 12–23, 1979). And in 1896, Svante Arrhenius argued that higher carbon dioxide concentrations should make the world warmer. Svante Arrhenius, On the Influence of Carbonic Acid in the Air Upon the Temperature on the Ground, 41 Phil. Mag. & J. Sci. 237 (1896).

[33]. This trend is also reflected in the general equilibrium models used to estimate climate damages. As William Nordhaus, creator of the well-known Dynamic Integrated Model of Climate and Economy, explained, “[i]n the coming decades, damages are predicted to rise relative to output. As that occurs, it becomes efficient to shift investments toward more intensive emissions reductions and the accompanying higher carbon taxes.” William Nordhaus, Critical Assumptions in the Stern Review on Climate Change, 317 Science 201, 201 (2007). Accordingly, while Nordhaus projects a thirty dollar optimal carbon tax in 2005, he projects a tax of eighty-five dollars by the mid-twenty-first century and an even higher tax in the future. Id.

[34]. Compare Nicholas Stern, The Stern Review on the Economics of Climate Change vi (2006) (warning that failure to immediately invest one percent of gross domestic product per year in reducing climate change will result in at least five percent GDP per year in economic losses) with Nordhaus, supra note 33, at 689 (contending that the Stern Review’s more dramatic damage estimates, which disappear when more conventional discount rates are used instead, are attributable primarily to the use of a zero discount rate).

[35]. Dobbs, supra note 22, at 214 § 3.1 (“In a sense, almost all damages are the product of conven-tions or convenient rules.”). One example of a legal convention for calculating damages is the use of statistical life expectancy tables to calculate the amount of damages owed to the plaintiff in a permanent physical injury case or in a wrongful death case. Id.

[36]. Zasloff, supra note 1, at 1865 (emphasis added).

[37]. 406 F. Supp. 2d 265 (S.D.N.Y. 2005), vacated, 582 F.3d 309 (2d Cir. 2009), cert. granted, 2010 U.S. LEXIS 9461 (Dec. 6, 2010) (No.10-174).

[38]. See Synthesis Report, supra note 28, at 50–51.

[39]. This figure is calculated by subtracting the approximate population of California, thirty-nine million, from the world population of 6,875,288,311. See U.S. & World Population Clocks, U.S. Census Bureau, http://www.census.gov/main/www/popclock.html (last visited Jan. 23, 2011).

[40]. See U.S. Energy Info. Admin., International Energy Annual 2006: World Per Capita Carbon Dioxide Emissions From the Consumption and Flaring of Fossil Fuels 1980–2006 (2008), available at http://www.eia.doe.gov/iea/carbon.html.

[41]. U.S. per capita emissions of 19.78 metric tons in 2006 is the highest per capita emissions rate in North America and among the highest rates in the world. Id. The U.S. per capita rate in 2006 is vastly greater than that of Central and South America, which averages at 2.03 metric tons, Africa, which averages 1.19 metric tons, and even Europe, with an average of 8.66 metric tons. Id.

[42]. Economic growth has traditionally been closely correlated with energy use. See, e.g., U.S. Energy Info. Admin., International Energy Outlook 2010, at 9–21 (2010), available at http://

www.eia.doe.gov/oiaf/ieo/pdf/0484(2010).pdf.

[43]. See, e.g., Assembly of the Afr. Union, Twelfth Ordinary Session, Decisions, Declarations, Message of Congratulations and Motion: Decision On The African Common Position on Climate Change, at ¶ 5 (2009), available at http://www.africa-union.org/root/ UA/Conferences/2009/Jan/Summit_Jan_2009/doc/CONFERENCE/ASSEMBLY%20AU%20DEC%20%20208-240%20(XII).pdf (“The Assembly . . . EMPHASIZES that the global carbon trading mech-anisms that are expected to emerge from international negotiations on climate change should give Africa an opportunity to demand and get compensation for the damage to its economy caused by global warming . . . .”); Inst. for Global Envtl. Strategies, Asian Aspirations for Climate Change Regime Beyond 2012, at 87–88, 89 tbl.6.3 (Ancha Srinivasan ed., 2006), available at http://enviroscope.

iges.or.jp/modules/envirolib/upload/535/attach/complete_report.pdf (discussing the numerous proposals linking financing of adaptation to historic emissions); see also Daniel A. Farber, The Case for Climate Compensation: Justice for Climate Change Victims in a Complex World, 2008 Utah L. Rev. 377, 380–81 (discussing the evolution in the developing countries’ claims for compensation for climate change damages from the United States).

[44]. See Saleemul Huq, Whither Adaptation Funding?, Hotspot, Nov. 2004, at 1, available at www.

climnet.org/resources/doc_download/1595-hotspot-35-nov-2004 (complaining that industrialized nations are failing to understand that international negotiations over their contribution to these funds “is not one of supplicant for more aid as charity . . . but as victims of pollution negotiating for compensation”).

[45]. For example, the onslaught of cases in asbestos litigation by minimally impaired plaintiffs threatens to exhaust the money available to compensate persons with more serious asbestos-related diseases. See, e.g., James L. Stengel, The Asbestos End-Game, 62 N.Y.U. Ann. Surv. Am. L. 223, 240 (2006) (“[T]he current system raises substantive issues of fairness among claimants and defendants alike. Healthy claimants may exhaust resources that would have been available to the truly ill.”).

[46]. See Richard S.J. Tol & Roda Verheyen, State Responsibility and Compensation for Climate Change Damages—A Legal and Economic Assessment, 32 Energy Pol’y 1109, 1125 (2004) (estimating that based upon cumulative emissions since 2000, the United States and Canada would, in the twenty-second century, pay damages up to 0.6 percent of their GDP, while Western Europe would pay up to 0.5 percent of their GDP, and Japan, Australia, and New Zealand up to 0.2 percent of their GDP).

[47]. Id. at 1125–26 (“As developing countries are responsible for a large share of future emissions, OECD [Organization for Economic Cooperation and Development] countries could claim a lot of compen-sation, particularly in the 22nd century. . . . Scenarios under which the responsibilities of developing countries exceed those of developed countries, and the net compensation flows are from South to North are not inconceivable.”); id. at 1127.

[49]. See infra sources cited in notes 50–54.

[50]. For a discussion of the English common law origins of the combined effect rule, see David Howarth, Muddying the Waters: Tort Law and the Environment, 41 Washburn L.J. 469, 485–87 (2002); Julian Morris, Climbing Out of a Hole: Sunsets, Subjective Value, the Environment, and the English Common Law, 14 Fordham Envtl. L. Rev. 343, 358 (2003).

[53]. Id. at 10. The court’s metaphorical use of a drop of poison is particularly apropos: “One drop of poison in a person’s cup, may have no injurious effect. But when a dozen, or twenty, or fifty, each put in a drop, fatal results may follow. It would not do to say that neither was to be held responsible.” Id.

[55]. Id. at 13; see also California v. Gold Run Ditch & Mining Co., 4 P. 1152, 1160 (Cal. 1884) (ordering the abatement of the defendant’s discharge of mining debris into a stream, which, together with the debris of other mines, constituted a nuisance despite the court’s inability to find that the defendant’s acts alone caused material injury); Lockwood Co. v. Lawrence, 77 Me. 297, 322–23 (1885) (holding the same with respect to the defendant’s contribution of saw mill refuse to a navigable river).

[56]. See cases cited supra note 55.

[57]. Zasloff, supra note 1, at 1840.

[62]. See Engel, supra note 6, at 1579–81.

[63]. See Daniel A. Farber, Apportioning Climate Change Costs, 26 UCLA J. Envtl. L. & Pol’y 21, 34 (2008).

[64]. A Pigouvian tax’s purpose is achieving the internalization of the negative externalities of the conduct taxed. See Arthur Cecil Pigou, The Economics of Welfare (Transaction Publishers 2002) (1952).

[65]. See Hal R. Varian, Microeconomic Analysis 434 (3d ed. 1992).

[66]. Despite the radical discount that this solution would entail, it may still be worthwhile for a U.S. state to pursue its fair share of the climate damages inflicted by U.S. sources upon the globe as a result of their past operations. Take, for instance, the carbon dioxide emissions of a single U.S. coal-fired power plant, which the EPA estimates at 3,850,479 metric tons. Suppose this plant has emitted this much carbon dioxide each year for the past thirty years. Assuming a thirty dollar per ton tax, California’s share on a per capita basis of the total global damages inflicted by this source over the past eighteen years (since 1992, the year the United Nations Framework Convention on Climate Change was signed) would be $11.7 million. This figure is generated by multiplying 3,850,479 metric tons of carbon dioxide per coal-fired power plant in the U.S. Thirty dollars a metric ton divided by the world population of 6,875,288,311 equals $0.30 in damages per person in the world. When $0.30 is multiplied by thirty-nine million, the population of California, the result is $11.7 million. If all 465 U.S. power plants were in operation for the past eighteen years and all the other assumptions were true, California’s total bill for climate damages against the U.S. coal-fired power sector would be $5.44 billion dollars ($11.7 million multiplied by the 465 coal-fired power plants in the United States). See Green Power Equivalency Calculator Methodologies, U.S. Envtl. Protection Agency, http://www.epa.gov/greenpower/pubs/calcmeth.htm#coalplant (last visited Jan. 23, 2011); U.S. and World Population Clocks, U.S. Census Bureau, http://www.census. gov/main/www/popclock.html (last visited Jan. 23, 2011). Of course, this is a vast oversimplification of the calculations that would be required to get a truly accurate damages figure. For instance, the thirty dollar a ton carbon tax is too high for most of the eighteen years, as Nordhaus considers that figure optimal for 2005, and damages from emissions prior to that time should be lower. See Nordhaus, supra note 33, at 201. The population figures are off as well. Eighteen years ago, there were fewer than 6.8 billion people in the world, but then again, there were also fewer than thirty-nine million Californians. I leave it to those with more facility with numbers to calculate a more accurate damages figure for California. I raise this only to indicate that the damages figure generated by a supposedly more fair approach to determine California’s share of climate damages—an approach that takes into account the global nature of the damages reflected in a carbon tax—is not insignificant.